Mobile phones have become indispensable companions in our daily lives, serving as mini-computers that cater to our communication, entertainment, and productivity needs. Given the value and importance of these devices, protecting them from damage, theft or malfunction is a major concern for many. Enter mobile phone insurance: a service designed to provide coverage for your precious device against unforeseen circumstances.

This general educational article aims to shed light on mobile phone insurance, answering the question: is it worth it? We will delve into the benefits and drawbacks of insurance options, equipping you with the knowledge you need to make an informed decision. Additionally, we’ll explore the best available mobile phone insurance options in Adelaide, so you can secure the right coverage for your device and enjoy peace of mind. Gear up as we dive deep into the world of mobile phone insurance and examine its worth in securing your device’s future.

1. What is Mobile Phone Insurance?

Mobile phone insurance provides coverage for various incidents that can cause damage or loss to your device. It usually involves a monthly or annual premium payment, which grants you protection against costs associated with repairing or replacing your mobile phone. Common scenarios covered by mobile phone insurance policies include accidental damage, theft, loss, and sometimes malfunctions that occur outside the manufacturer’s warranty period.

2. Benefits of Mobile Phone Insurance

Having mobile phone insurance can come in handy in multiple ways, providing several benefits to policyholders:

- Peace of mind: Knowing that your mobile phone is protected against unforeseen accidents, theft, or malfunction can offer significant relief. In case of an unfortunate event, the insurance coverage minimises the financial burden of device repair or replacement.

- Financial savings: The cost of repairing or replacing a high-end smartphone can amount to several hundred dollars. With mobile phone insurance, the costs incurred for fixing or replacing your device are significantly reduced or eliminated, depending on the policy coverage.

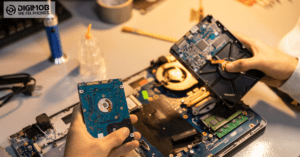

- Efficient repairs: Insurance providers typically partner with reputable repair centres to offer fast and efficient device repairs for their policyholders. This ensures that your gadget is fixed by trusted technicians in a timely manner, minimising any inconvenience.

3. Drawbacks of Mobile Phone Insurance

Despite its benefits, mobile phone insurance may not be the right choice for everyone. Before investing in a policy, it’s essential to consider some of its potential drawbacks:

- Premium costs: Paying regular premiums for mobile phone insurance can add up quickly. Depending on the policy and your device’s value, insurance can amount to a significant expense over time.

- Excess fees: Most insurance policies impose excess fees in addition to the premium, which must be paid when claiming coverage. These fees may vary depending on the type of claim and could be high, limiting the overall financial benefits of the insurance.

- Coverage limitations: Mobile phone insurance policies often come with limitations or exclusions for specific scenarios. For example, water damage may be excluded, or claims for theft may only be valid if accompanied by a police report. It’s crucial to read the fine print and understand what’s covered before committing to a policy.

4. Evaluating Whether Mobile Phone Insurance is Right for You

To determine if mobile phone insurance is a worthwhile investment, consider the following factors:

- Value of your device: If your mobile phone is a high-end model with a significant price tag, insurance may be a more cost-effective solution in the event of damage or theft. On the other hand, insurance may be less necessary for inexpensive devices, where repair or replacement costs would be minimal.

- Personal habits and circumstances: Accidents happen, but if you have a history of dropping your phone or frequently misplacing your belongings, insurance may provide valuable peace of mind. Similarly, living or working in a high-risk area for theft could make them more appealing.

- Manufacturer’s warranty: Mobile phone manufacturer warranties typically cover defects and malfunctions for up to two years from the date of purchase. Assess to what extent the manufacturer’s warranty covers your device to determine if additional insurance coverage is necessary.

5. Best Mobile Phone Insurance Options in Adelaide

Several options for mobile phone insurance are available in Adelaide, ranging from carrier-provided plans to third-party insurers. It’s crucial to research and compare these options to find the most suitable coverage. Some popular choices include:

- Carrier-provided plans: Many mobile carriers offer their own insurance policies, such as Telstra’s Device Protect. These plans often provide comprehensive coverage and quick claim processing since the carrier is already familiar with your device and plan.

- Bank and credit card insurance: Some banks and credit card companies offer mobile phone insurance as an additional perk for their clients. Check if your credit card provider or bank offers such coverage, and evaluate if it meets your needs.

- Third-party insurers: Several insurance providers, including gadget-specific insurers like Device Insure, offer mobile phone insurance. These policies can be tailored to your specific needs and may offer more flexibility in terms of coverage and claims.

Take time to study the available insurance options in Adelaide, compare their coverage, premiums, excess fees, and restrictions to find the best policy that aligns with your needs and budget.

Mobile phone insurance can be a valuable investment for some individuals, offering peace of mind and financial protection in case of damage, theft, or malfunction. Carefully weigh the advantages and disadvantages, evaluate your personal needs and circumstances, and explore the available options in Adelaide before committing to an insurance policy that suits your mobile phone protection requirements.

Conclusion

Mobile phone insurance offers valuable protection for your device in the event of damage, theft, or malfunction. It’s essential to weigh the advantages and drawbacks, consider your personal needs and circumstances, and explore the various options available in Adelaide when deciding whether to invest in mobile phone insurance.

At Digimob Phone Repairs, we understand the importance of keeping your mobile device in peak condition. While insurance can offer protection, it’s also crucial to have a reliable and reputable mobile repair centre like Digimob Phone Repairs to assist with any repairs or replacement requirements. Our highly skilled technicians provide top-quality, efficient repairs for a diverse range of smartphone brands and models.

Explore our comprehensive mobile phone repairs, and experience the peace of mind knowing that Digimob Phone Repairs is dedicated to maintaining your device’s health and performance, giving you the best mobile experience possible.